.

China’s government announced plans for a consumer-led revival of the struggling economy as its legislature opened a session on Sunday.

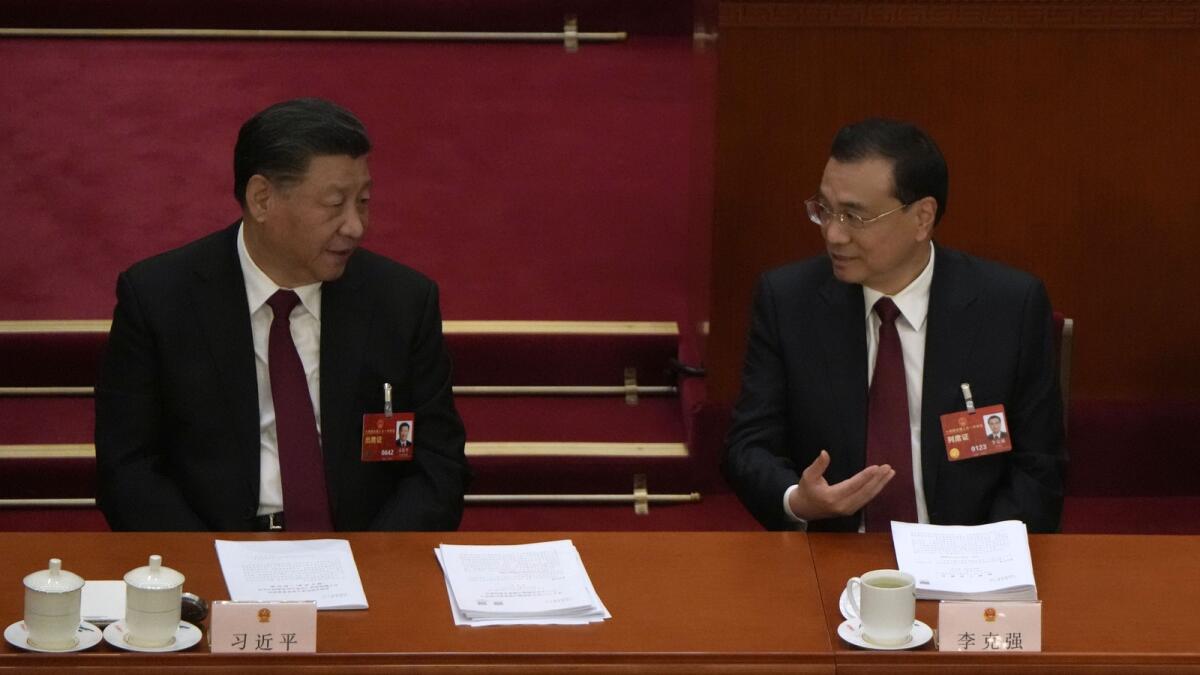

Premier Li Keqiang, the top economic official, set this year’s growth target at “around 5 per cent” following the end of anti-virus controls that kept millions of people at home and triggered protests. Last year’s growth in the world’s second-largest economy fell to 3 per cent, the second-weakest level since at least the 1970s.

“We should give priority to the recovery and expansion of consumption,” Li said in a speech on government plans before the ceremonial National People’s Congress in the Great Hall of the People in central Beijing.

President Xi Jinping’s new leadership team will face challenges ranging from weak global demand for exports and lingering US tariff hikes in a feud over technology and security to curbs on access to Western processor chips due to security fears.

Li’s report called for boosting consumer spending by increasing household incomes but gave no details in his unusually brief, 53-minute speech. It was less than half the length of work reports in some previous years.

The premier called for “building up our country’s strength and self-reliance in science and technology,” an area in which Beijing’s state-led efforts to create competitors in electric cars, clean energy, telecoms and other fields have strained relations with Washington and other trading partners.

Xi earlier singled out encouraging jittery consumers and entrepreneurs to spend and invest as a priority at the ruling party’s economic planning meeting in December.

Beijing needs to “fully release consumption potential,” Xi said, according to a text released last month.

Since taking power in 2012, Xi has promoted an even more dominant role for the ruling party. He has called for the party to return to its “original mission” as China’s economic, social and cultural leader and carry out the “rejuvenation of the great Chinese nation.”

Xi’s government has tightened control over e-commerce and other tech companies with anti-monopoly and data security crackdowns that wiped billions of dollars off their stock market value. Beijing is pressing them to pay for social welfare and official initiatives to develop processor chips and other technology. That has prompted warnings economic growth will suffer.

Li’s report on Sunday reinforced the importance of state industry. It promised to support entrepreneurs who generate jobs and wealth but also said the government will “enhance the core competitiveness” of state-owned companies that dominate industries from banking and energy to telecoms and steel.

Chinese economic growth has struggled since mid-2021, when tighter controls on debt that Beijing worries is dangerously high triggered a slump in the vast real estate industry, which supports millions of jobs. Smaller developers were forced into bankruptcy and some defaulted on bonds, causing alarm in global financial markets.

Longer term, the workforce has been shrinking for a decade, putting pressure on plans to increase China’s wealth and global influence.

Consumer spending is gradually recovering, but the International Monetary Fund and some private sector forecasters expect economic growth this year as low as 4.4 per cent, well below the official target.

A measure of factory activity rose to a nine-year high in February. Other measures of activity including the number of subway passengers and express deliveries rose.

A central bank official said on Friday that real estate activity is recovering and lending for construction and home purchases is rising.

A recovery based on consumer spending is likely to be more gradual than one driven by government stimulus or a boom in real estate investment. But Chinese leaders are trying to avoid reigniting a rise in debt and want to nurture self-sustaining growth based on consumption instead of exports and investment.

If achieved, the official growth target would be an improvement over last year but down sharply from 2021’s 8.1 per cent.

Last year’s slump had global repercussions, depressing Chinese sales of autos and consumer goods and demand for oil, food and other imports. Even after the end of anti-virus curbs, auto sales fell by double digits in January and retail sales contracted.

Entrepreneurs and foreign companies have been rattled by tighter political controls.

Foreign business groups said last year global companies were shifting investment plans away from China because travel curbs blocked executives from visiting the country.

Li, the premier, tried to reassure foreign investors by promising to open Chinese markets wider and repeating official pledges of equal treatment with domestic enterprises.

“China is sure to provide even greater business opportunities for foreign companies,” he said.

The party has indicated its tech crackdown is winding down but has given no sign it is backing off a campaign to tighten political control over the industry.

Entrepreneurs were shaken anew in mid-February when a star banker, Bao Fan, who was involved in some of the biggest tech deals, disappeared. His company announced last week Bao was “cooperating in an investigation” but gave no details.